By Eric-Ștefan Duma, Class of 2028

On November 21, Peking University Associate Professor Liu Yunting delivered an Economics seminar at Duke Kunshan University, where he presented his recent research, “Digitalization, Selection, and Misallocation: Evidence from Firm-Level Data in China.” Drawing on extensive firm-level data, his study develops and empirically tests a model that connects digital technology adoption with productivity differences and resource misallocation across Chinese firms.

Prof. Liu is a tenured faculty member in the School of Economics at Peking University, serving as Associate Chair of the Finance Department and as a PhD advisor. His research spans asset pricing, financial economics, and macro-finance, with publications in leading journals such as Management Science, Journal of Banking and Finance, Economic Research Journal (经济研究), China Industrial Economics (中国工业经济), and Journal of Management Sciences (管理科学学报).

The term “digital economy” refers to an economic system in which data are the main factor of production and technologies drive structural transformations and value creation. At the microeconomic level, this is evident in firms introducing digital technologies to enhance productivity and improve resource allocation. At the macroeconomic level, the digital economy is associated with value created by digital industries and sector-level efficiency gains from digitalization.

In his presentation, Prof. Liu began by outlining the broader context of China’s digital economy, in which data and technology have become central drivers of productivity and structural change. Although digital tools have the potential to enhance efficiency, he noted that the extent of digital adoption varies significantly across industries, regions, and firm types. This raises a deeper question: are these differences the result of uneven technological opportunities, or do they reflect distortions in how resources are allocated within the economy?

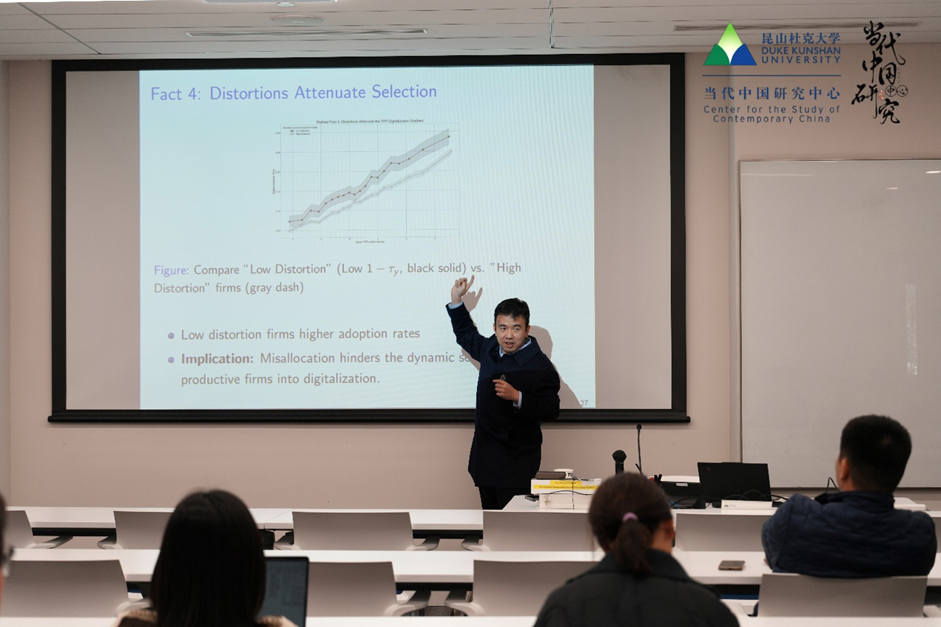

To address this, Prof. Liu’s model examines how both productivity fundamentals and market frictions shape firms’ incentives to adopt digital technologies. His empirical analysis uses multiple measures of digitalization—from patent data to technology expenditures captured in China’s Tax Survey Data—to trace how digital adoption interacts with labor, capital, and output decisions. His findings show that digitalization complements rather than replaces labor and capital, particularly skilled labor, as reflected in rising wages among more digitally intensive firms. However, capital and output distortions weaken the selection mechanism that typically drives efficient technology adoption, resulting in lower-than-optimal levels of digital integration.

Prof. Liu concluded by highlighting the implications for policy. Enhancing firms’ digital efficiency and reducing capital and output distortions, he argued, would significantly increase the gains from digitalization for China’s wider economy.

This seminar was jointly organized by Duke Kunshan University’s Division of Social Sciences, the Center for the Study of Contemporary China, and the Environmental Research Center.